The Ethereum Merge is done, Opening a New Era of Proof-of-Stake

The long-awaited Ethereum update, known as “the merge,” is finally done today.

“And we finalized! Happy merge, all. This is a big moment for the Ethereum ecosystem,” Vitalik Buterin, co-founder of Ethereum, said on Twitter on Sept. 15. Below is the most important change that “The Merge” will bring to us:

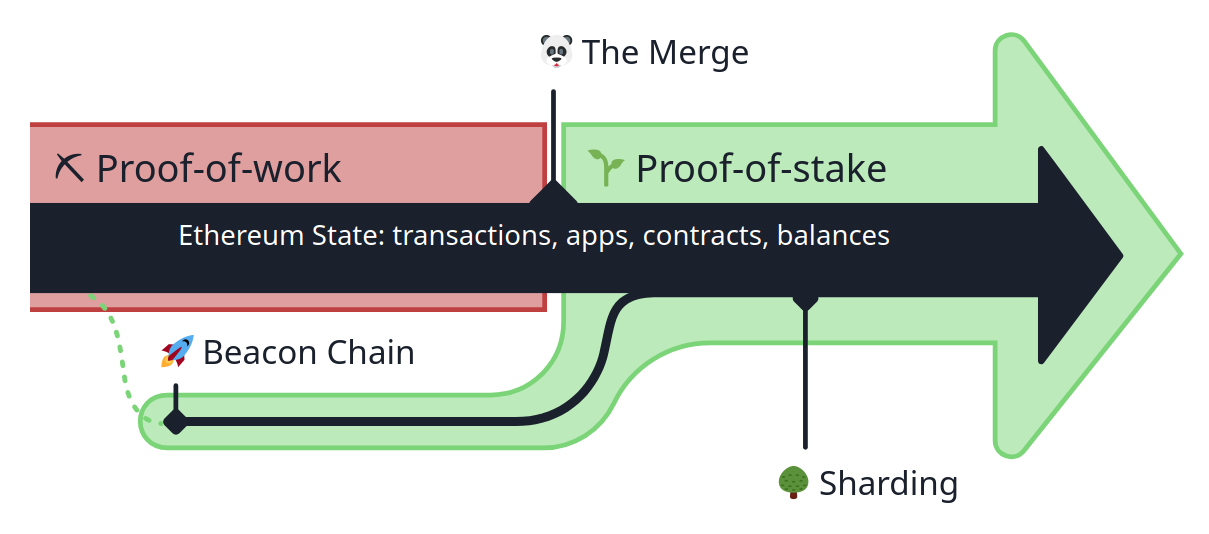

- Ethereum Mainnet uses proof-of-stake, but this wasn’t always the case.

- The upgrade from the original proof-of-work mechanism to proof-of-stake was called The Merge.

- The Merge refers to the original Ethereum Mainnet merging with a separate proof-of-stake blockchain called the Beacon Chain, now existing as one chain.

- The Merge reduced Ethereum’s energy consumption by ~99.95%.

What is The Merge?

The Merge was the joining of the original execution layer of Ethereum (the Mainnet that has existed since genesis) with its new proof-of-stake consensus layer, the Beacon Chain. It eliminated the need for energy-intensive mining and instead enabled the network to be secured using staked ETH. It was a truly exciting step in realizing the Ethereum vision—more scalability, security, and sustainability.

Initially, the Beacon Chain shipped separately from Mainnet. Ethereum Mainnet – with all it’s accounts, balances, smart contracts, and blockchain state – continued to be secured by proof-of-work, even while the Beacon Chain ran in parallel using proof-of-stake. The Merge was when these two systems finally came together, and proof-of-work was permanently replaced by proof-of-stake.

Proof-of-work secured Ethereum Mainnet from genesis until The Merge. This allowed the Ethereum blockchain we’re all used to to come into existence in July 2015 with all its familiar features—transactions, smart contracts, accounts, etc.

Throughout Ethereum’s history, developers prepared for an eventual transition away from proof-of-work to proof-of-stake. On December 1, 2020, the Beacon Chain was created as a separate blockchain to Mainnet, running in parallel.

The Beacon Chain was not originally processing Mainnet transactions. Instead, it was reaching consensus on its own state by agreeing on active validators and their account balances. After extensive testing, it became time for the Beacon Chain to reach consensus on real world data. After The Merge, the Beacon Chain became the consensus engine for all network data, including execution layer transactions and account balances.

The Merge represented the official switch to using the Beacon Chain as the engine of block production. Mining is no longer the means of producing valid blocks. Instead, the proof-of-stake validators have adopted this role and are now responsible for processing the validity of all transactions and proposing blocks.

No history was lost in The Merge. As Mainnet merged with the Beacon Chain, it also merged the entire transactional history of Ethereum.

What is Proof-of-Stake?

Proof-of-stake (PoS) protocols are a class of consensus mechanisms for blockchains that work by selecting validators in proportion to their quantity of holdings in the associated cryptocurrency. This is done to avoid the computational cost of proof-of-work schemes. The first functioning use of PoS for cryptocurrency was Peercoin in 2012.

For a blockchain transaction to be recognized, it must be appended to the blockchain. Validators carry out this appending; in most protocols, they receive a reward for doing so.For the blockchain to remain secure, it must have a mechanism to prevent a malicious user or group from taking over a majority of validation. PoS accomplishes this by requiring that validators have some quantity of blockchain tokens, requiring potential attackers to acquire a large fraction of the tokens on the blockchain to mount an attack.

Proof of work, another commonly used consensus mechanism, uses a validation of computational prowess to verify transactions, requiring a potential attacker to acquire a large fraction of the computational power of the validator network.This incentivizes consuming huge quantities of energy. PoS is more energy-efficient.

What is Ethereum?

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ether (Abbreviation: ETH;[a] sign: Ξ) is the native cryptocurrency of the platform. Among cryptocurrencies, ether is second only to bitcoin in market capitalization.

Ethereum was conceived in 2013 by programmer Vitalik Buterin.Additional founders of Ethereum included Gavin Wood, Charles Hoskinson, Anthony Di Iorio and Joseph Lubin.In 2014, development work began and was crowdfunded, and the network went live on 30 July 2015.Ethereum allows anyone to deploy permanent and immutable decentralized applications onto it, with which users can interact. Decentralized finance (DeFi) applications provide a broad array of financial services without the need for typical financial intermediaries like brokerages, exchanges, or banks, such as allowing cryptocurrency users to borrow against their holdings or lend them out for interest. Ethereum also allows users to create and exchange NFTs, which are unique tokens representing ownership of an associated asset or privilege, as recognized by any number of institutions. Additionally, many other cryptocurrencies utilize the ERC-20 token standard on top of the Ethereum blockchain and have utilized the platform for initial coin offerings.

On 15 September 2022, Ethereum transitioned its consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS) in an upgrade process known as “the Merge”. Consequently, Ethereum’s energy consumption rate was reduced by about 99.95%, translating to an estimated 110 TWh of annual energy savings (110 billion kilowatt-hours). The upgrade required no actions from Ethereum’s users.During the Merge, Ethereum’s proof-of-work mining mechanism was replaced with the Beacon Chain, a proof-of-stake blockchain network secured by validators staking ether.

What is Ethereum 2.0?

In December 2020, Ethereum began running on two parallel blockchains, a legacy one that operates using proof of work (Ethereum Mainnet) and a new chain for proof of stake (Beacon Chain). The merge combined Ethereum’s Mainnet and Beacon Chain into one unified blockchain operating on a proof of stake protocol.

The Beacon Chain has acted as a proof-of-stake ledger on the Mainnet since its launch in 2020.The Ethereum Mainnet and Beacon Chain were originally referred to as ETH1 and ETH2, respectively. Their eventual merge was expected to be called Ethereum 2.0.

However, in January, the Ethereum Foundation asked users to start phasing out the term Ethereum 2.0. The Foundation decided that language no longer accurately represented their roadmap. They believed Ethereum 2.0 sounded too much like a different operating system, which is not at all what the merge is intended to implement.

With Ethereum 2.0 no longer in the official vocabulary, the Ethereum Foundation also asked users to refer to the Ethereum Mainnet as the “execution layer” rather than ETH1 and the Beacon Chain as the “consensus layer,” rather than ETH2. This terminology, they believe, better reflected their goals for the platform.

However, many crypto investors and enthusiasts still refer to post-merge Ethereum as Ethereum 2.0.

Ethereum moves from Mining to Staking

With the completion of Ethereum’s merge, the staking process replaces the mining one for verifying transactions.

Staking requires users to lock up a certain amount of cryptocurrency to participate in the transaction verification process. In a proof-of-stake model, an algorithm selects which validator gets to add the next block to a blockchain-based on how much cryptocurrency the validator has staked.

Investors must stake at least 32 ETH to become an Ethereum validator. There are currently more than 300,0000 Ethereum validators. The more ETH each validator stakes, the more likely that validator is to produce blocks. Each time a validator produces blocks, the validator earns rewards in Ethereum for handling validation duties.

With Ethereum trading at nearly $1,600, the minimum requirement of 32 ETH is more than $50,000; staking can be quite pricey for the average investor.

But individual investors can also join staking pools, which are collections of Ethereum stakers who combine their resources and split the rewards. Most large cryptocurrency exchanges also provide staking services for investors who are not willing or able to commit 32 ETH on their own.

Goodbye Miners and Hello Stakers

In 2008, Bitcoin introduced the world to the idea of a decentralized ledger – a single, immutable record of transactions that computers around the world could view, alter and trust without the need for intermediaries.

Ethereum, introduced in 2015, expanded upon the core concepts of Bitcoin with smart contracts – or computer programs that effectively use the blockchain as a global supercomputer, recording data onto its network. That innovation was the essential ingredient behind decentralized finance (DeFi) and NFTs – the main catalysts of the most recent crypto boom.

The Merge retires Ethereum’s proof-of-work system, where crypto miners competed to write transactions to its ledger – and earn rewards for doing so – by solving cryptographic puzzles.

Most crypto mining today happens in “farms,” though they may be more aptly described as factories. Picture massive warehouses lined with rows of computers stacked on top of one another like shelves of books at a university library – each computer hot to the touch as it strains to pump out cryptocurrency.

This system, which was pioneered by Bitcoin, is what caused Ethereum to guzzle so much energy and is responsible for fueling the blockchain sector’s reputation as an environmental menace.

Ethereum’s new system, proof-of-stake, does away with mining entirely.

Miners are replaced by validators – people who “stake” at least 32 ETH by sending them to an address on the Ethereum network where they cannot be bought or sold.

These staked ETH tokens act like lottery tickets: The more ETH a validator stakes, the more likely one of its tickets will be drawn, granting it the ability to write a “block” of transactions to Ethereum’s digital ledger.

Ethereum introduced a proof-of-stake network in 2020 called the Beacon Chain, but until the Merge it was just a staging area for validators to get set up for the switch. Ethereum’s transition to proof-of-stake involved merging the Beacon Chain with Ethereum’s main network.

What is the Next?

“This is the first step in Ethereum’s big journey towards being a very mature system, but there are still steps left to go,” said Vitalik Buterin, Ethereum’s co-creator, as he reflected on the Merge during Thursday’s viewing party. He went on to mention Ethereum’s relatively high fees and slow speeds, which were not addressed by the update, but remain as much a barrier to growing the network’s user base as environmental concerns ever was.

Buterin, Ethereum’s most visible figurehead, previously outlined a set of next steps for the network that includes “sharding” – a method that should help address the network’s sluggish transaction times and high fees by spreading transactions across “shards,” like adding lanes to a highway.

That upgrade was initially slated to accompany the transition to proof-of-stake, but it was deprioritized given the success that third-party solutions – called rollups – have had in solving some of the same issues.

Rollups foreshadow the likely future for Ethereum development, where community solutions – rather than updates to Ethereum’s core code – play the primary role in expanding the chain’s capabilities.

For Buterin, the Merge is just the beginning. “To me, the Merge just symbolizes the difference between early stage Ethereum, and the Ethereum we’ve always wanted … to become,” he said on Thursday’s live stream. “So let’s go build out all of the other parts of this ecosystem and turn Ethereum into what we want it to be.”

Reference:

- https://ethereum.org/en/upgrades/merge

- https://en.wikipedia.org/wiki/Ethereum